- Прогнозирование временных рядов python sarima

- SARIMA Modeling

- Implementation

- Data Preprocessing

- Identifying Variance, Trend and Seasonality in the data

- Thumb Rule for Statistical Tests –

- ACF and PACF Plots

- Model Creation

- Running the SARIMA model

- Residual Check

- And the final output

- Hurray! We have reached the end.

- Time Series Forecasting with SARIMA in Python

- Hands-on tutorial on time series modelling with SARIMA using Python

- SARIMA Model

- ACF and PACF plots

Прогнозирование временных рядов python sarima

A stationary time series is the one that does not have any trend or seasonality. It is essential to remove any trend or seasonality before modeling the time series data because if the statistical properties do not change over time, it is easier to model the data accurately. One of the popular ways of making the series stationary is differencing.

SARIMA Modeling

Modeling a time series data is a highly subjective and individual process. One may have different parameters for the same time series. Hence, there is no fixed solution. The best solution is the one that successfully fulfills the business requirements. Owing to this level of subjectivity involved, it sometimes gets tough to understand the model building process.

Several studies, tutorials, and implementations later, I was able to crunch the findings into a framework. This framework helps to understand the model building process in a structured manner. It involves the following steps –

- Plot the series – to check for outliers

- Transform the data (to make mean and variance constant)

- Apply statistical tests to check if the series is stationary (Both trend and seasonality)

- If non-stationary (has either trend or seasonality), make it stationary by differencing

- Plot ACF of stationary series for MA order, Seasonal MA order at seasonal spikes

- Plot PACF of stationary series for AR order, Seasonal AR order at seasonal spikes

- Run SARIMA with those parameters

- Check for model validity using residual plots

Please note that the above-mentioned list is not exhaustive. It does not cover all possible scenarios. However, by following these steps, one would be able to build a basic working SARIMA model. The later subjectivity, in terms of finding the ideal parameters, will still remain.

Now that we have set up the basic context and the framework on which we need to build the model, let us get our hands dirty by doing some coding.

Implementation

Let us start by importing the required python packages –

import warnings import itertools import numpy as np import matplotlib.pyplot as plt import pandas as pd import statsmodels.api as sm import matplotlib import pmdarima as pmData Preprocessing

Once we are done importing the packages, we import the AQI dataset from the local machine. Alternatively, the data can be imported using the Kaggle API directly into the project. For the scope of understanding, we will use the AQI data of Delhi to do the analysis.

series = pd.read_csv('/Users/pranshu/Documents/Work/Datasets/city_day.csv') series_delhi = series.loc[series['City'] == 'Delhi'] ts_delhi = series_delhi[['Date','AQI']] #converting 'Date' column to type 'datetime' so that indexing can happen later ts_delhi['Date'] = pd.to_datetime(ts_delhi['Date'])After importing the data, we will extract the ‘Date’ and ‘AQI’ columns. We then check for empty/NaN fields and remove them. Finally, we index the data frame by ‘Date’. (Index refers to a position within an ordered list. Here is a link to understand the concepts of indexes in python)

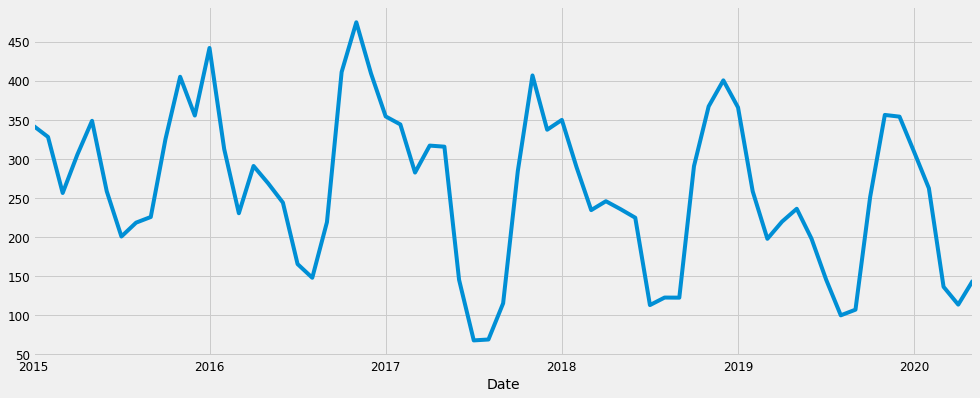

ts_delhi.isnull().sum() ts_delhi = ts_delhi.dropna() ts_delhi.isnull().sum() ts_delhi = ts_delhi.set_index('Date')We then aggregate the data from daily to monthly in order to carry out the analysis (Working with daily data can be cumbersome). Plotting the series should yield the following –

ts_month_avg = ts_delhi['AQI'].resample('MS').mean() ts_month_avg.plot(figsize = (15, 6)) plt.show()Voila! Our data is ready to be used.

Identifying Variance, Trend and Seasonality in the data

As we can see from the plot above, the mean and the variance of the data remains same throughout the data. Hence, there is no need to transform the data. We now proceed to check the trend and seasonal components of the data. Each time series can be decomposed into 3 components –

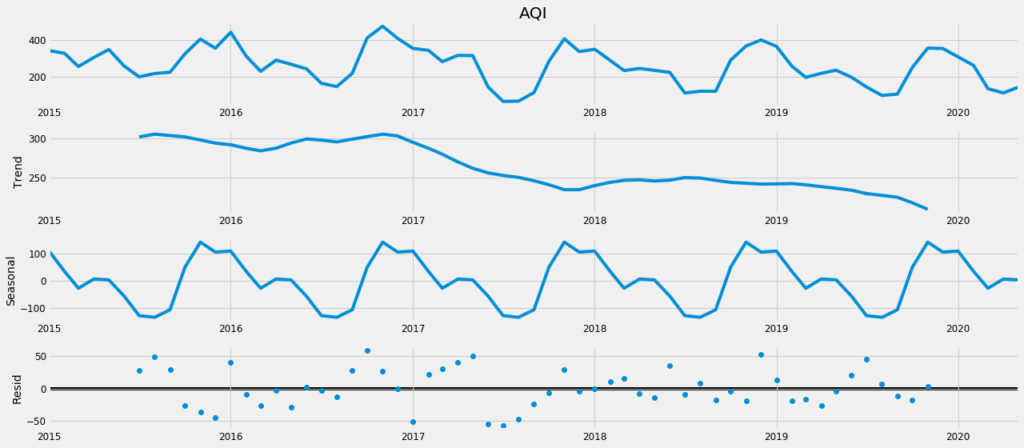

Let us see our decomposed time series –

from pylab import rcParams rcParams['figure.figsize'] = 18, 8 decomposition = sm.tsa.seasonal_decompose(ts_month_avg, model='additive') fig = decomposition.plot() plt.show()As we can see, there is a downward trend and an annual seasonality (lag = 12) in the data. We can also verify the presence of seasonality by looking at the ACF plot. It shows spikes at lag values 12, 24, 36, and so on. Therefore the series is not stationary. We have to remove it in order to do the analysis. It will be done by differencing and verified using statistical tests like ADF (for trend) and OSCB (for seasonality).

Thumb Rule for Statistical Tests –

ADF: if the p-value is less than the critical value, the series is stationary

OSCB: if the value is less than 0.64, the series is stationary

from statsmodels.tsa.stattools import adfuller def adf_test(timeseries): #Perform Dickey-Fuller test: print ('Results of Dickey-Fuller Test:') dftest = adfuller(timeseries, autolag='AIC') dfoutput = pd.Series(dftest[0:4], index=['Test Statistic','p-value','#Lags Used','Number of Observations Used']) for key,value in dftest[4].items(): dfoutput['Critical Value (%s)'%key] = value print (dfoutput) print(adf_test(ts_month_avg))After running the ADF test on the time series, we obtain the following output. Since the p-value of 0.96 is greater than the critical value of 0.05, we can statistically confirm that the series is not stationary. Hence, we would do first-order differencing for the trend and re-run the ADF test to check for stationarity.

Results of Dickey-Fuller Test: Test Statistic 0.041809 p-value 0.961856 #Lags Used 11.000000 Number of Observations Used 53.000000 Critical Value (1%) -3.560242 Critical Value (5%) -2.917850 Critical Value (10%) -2.596796 dtype: float64 None

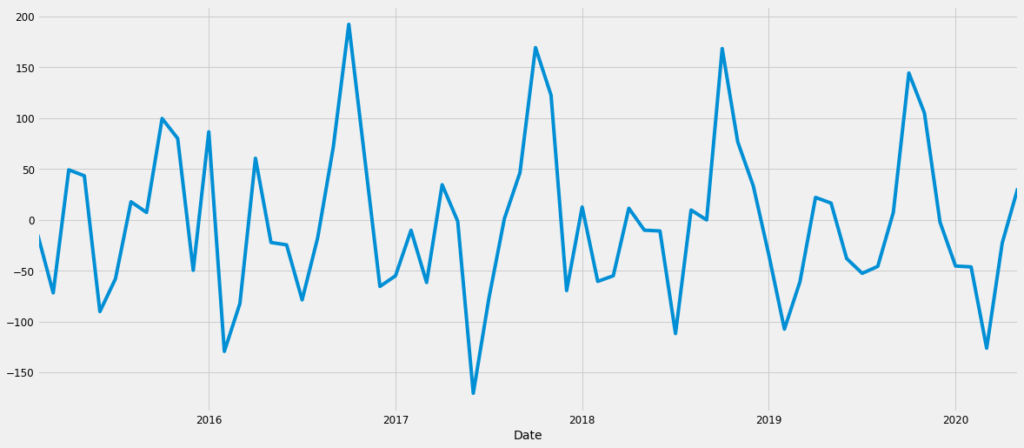

ts_t_adj = ts_month_avg - ts_month_avg.shift(1) ts_t_adj = ts_t_adj.dropna() ts_t_adj.plot() print(adf_test(ts_month_avg))The trend now seems to have disappeared from the data. Running the ADG test validates the observation. The p-value is less than the critical value of 0.05. Hence we can confirm that the series is now trend stationary.

Results of Dickey-Fuller Test: Test Statistic -6.654613e+00 p-value 5.020683e-09 #Lags Used 1.000000e+01 Number of Observations Used 5.300000e+01 Critical Value (1%) -3.560242e+00 Critical Value (5%) -2.917850e+00 Critical Value (10%) -2.596796e+00 dtype: float64 None

Let us now move onto seasonal differencing. Since the data is showing an annual seasonality, we would perform the differencing at a lag 12, i.e yearly.

ts_s_adj = ts_t_adj - ts_t_adj.shift(12) ts_s_adj = ts_s_adj.dropna() ts_s_adj.plot()Quick Hack – use the following python functions in the pmdarima package to identify the differencing order for trend and seasonality. These functions perform the statistical tests mentioned above out of the box.

- ndiffs(time_series) – count differencing order for the trend

- nsdiffs(time_series, lag) – count differencing order for seasonality

Alternatively, if nsdiffs() shows ‘0’ as output and there is a clear seasonal component in the data, use the following code snippet –

Insert Code here #pitfall #takes default_lag_value = 3. Change it to the lag for seasonal component as per the data.Now that the data are stationary, let us proceed to the next step in the process – the ACF and PACF plots.

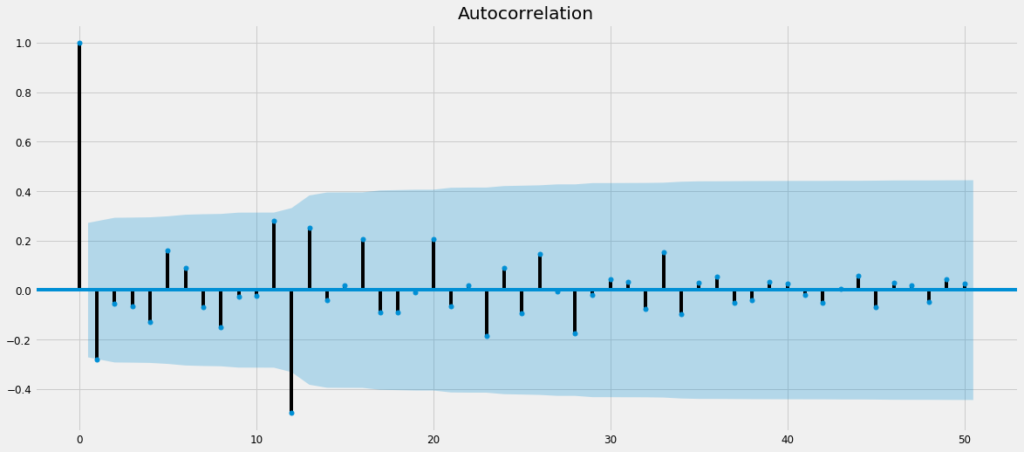

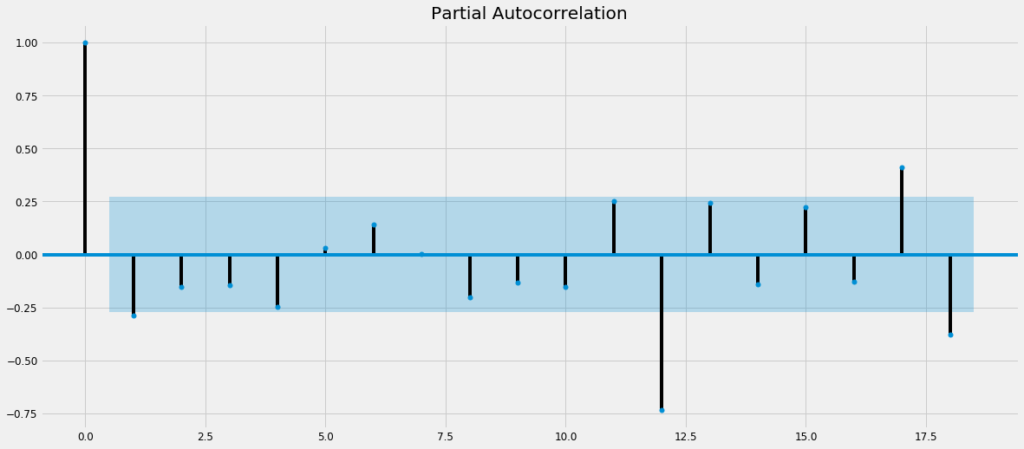

ACF and PACF Plots

By now, we have been able to identify 3 out of 7 components for our SARIMA equation. Those are trend differencing order(d), seasonal differencing order(D) and lag = 12. Let us now try and figure out the other 4 components, i.e – p and seasonal P, q and seasonal Q. In order to figure these out, we would need to plot the ACF and PACF plots.

ACF stands for Auto Correlation Function and PACF stands for Partial Auto Correlation Function.

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf plot_acf(ts_s_adj) matplotlib.pyplot.show() plot_pacf(ts_s_adj) matplotlib.pyplot.show()The code yeids the following –

- For ACF plot, initial spikes at lag = 1 and seasonal spikes at lag = 12, which means a probable AR order of 1 and seasonal AR order of 1

- For PACF plot, initial spikes at lag = 1 and seasonal spikes at lag = 12, which means a probable MA order of 1 or 2 and seasonal MA order of 1

So, our probable SARIMA model equation can be –

SARIMA(1,1,1)x(1,1,1)12

Model Creation

Since we are unsure of the exact model equation, we will perform a grid search with the list of possible values around our estimated parameters. We will then pick the model with the least AIC.

p = range(0, 3) d = range(1,2) q = range(0, 3) pdq = list(itertools.product(p, d, q)) seasonal_pdq = [(x[0], x[1], x[2], 12) for x in list(itertools.product(p, d, q))] print('Examples of parameter combinations for Seasonal ARIMA. ') print('SARIMAX: <> x <>'.format(pdq[1], seasonal_pdq[1])) print('SARIMAX: <> x <>'.format(pdq[1], seasonal_pdq[2])) print('SARIMAX: <> x <>'.format(pdq[2], seasonal_pdq[3])) print('SARIMAX: <> x <>'.format(pdq[2], seasonal_pdq[4])) for param in pdq: for param_seasonal in seasonal_pdq: try: mod = sm.tsa.statespace.SARIMAX(y, order=param, seasonal_order=param_seasonal, enforce_stationarity=False, enforce_invertibility=False) results = mod.fit() print('ARIMA<>x<>12 - AIC:<>'.format(param, param_seasonal, results.aic)) except: continueFrom the output we can see, the model yields – SARIMA(0, 1, 1)x(2, 1, 0, 12)

Running the SARIMA model

Upon obtaining the model orders from the grid search above, we fit a SARIMA model to our data.

Optimization terminated successfully. Current function value: 4.299277 Iterations: 5 Function evaluations: 301 ============================================================================== coef std err z P>|z| [0.025 0.975] ------------------------------------------------------------------------------ ma.L1 -1.0000 0.424 -2.359 0.018 -1.831 -0.169 ar.S.L12 -1.2291 0.176 -6.991 0.000 -1.574 -0.884 ar.S.L24 -0.6744 0.156 -4.321 0.000 -0.980 -0.369 sigma2 2697.9323 0.000 1.72e+07 0.000 2697.932 2697.933 ==============================================================================

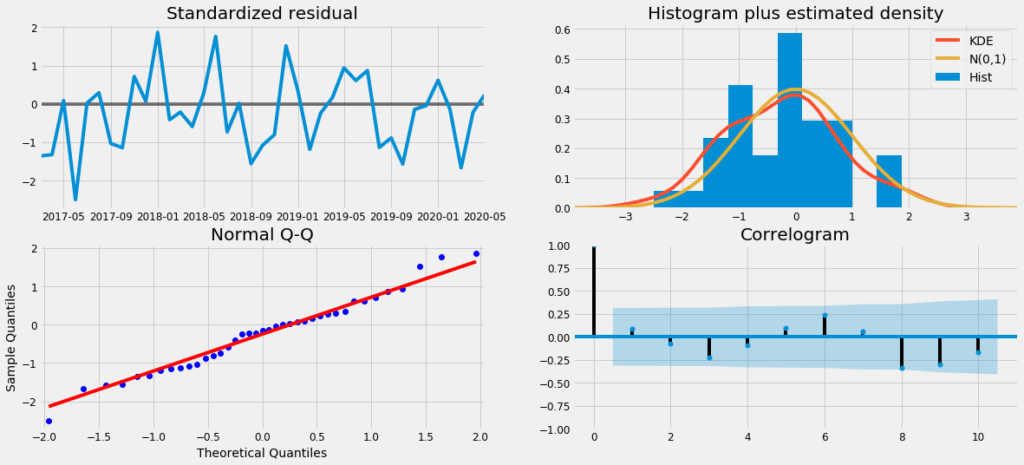

Residual Check

Once we have a fitted model to the data, it is necessary to check the residual plots to verify the validity of the model fit. A good forecasting method will yield residuals with the following properties:

- The residuals are uncorrelated. If there are correlations between residuals, then there is information left in the residuals that should be used in computing forecasts.

- The residuals have zero mean. If the residuals have a mean other than zero, then the forecasts are biased.

As we can see from the image above, the residuals are uncorrelated and have zero mean. Hence we can say the model is fitted well.

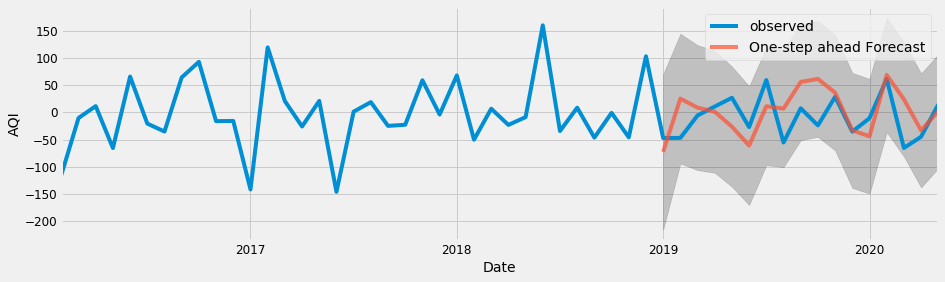

And the final output

To evaluate the model performance, we use Root Mean Squared Error (RMSE).

y_forecasted = pred.predicted_mean y_truth = ts_s_adj['2019-01-01':] mse = ((y_forecasted - y_truth) ** 2).mean() print('The Mean Squared Error is <>'.format(round(mse, 2))) print('The Root Mean Squared Error is <>'.format(round(np.sqrt(mse), 2)))The Mean Squared Error is 2083.03 The Root Mean Squared Error is 45.64

Hurray! We have reached the end.

As promised, the complete code can be found at this github repository.

If this article was helpful, do let us know in the comment section below. Till then, keep learning!

Time Series Forecasting with SARIMA in Python

Hands-on tutorial on time series modelling with SARIMA using Python

In previous articles, we introduced moving average processes MA(q), and autoregressive processes AR(p). We combined them and formed ARMA(p,q) and ARIMA(p,d,q) models to model more complex time series.

Now, add one last component to the model: seasonality.

- Seasonal ARIMA models

- A complete modelling and forecasting project with real-life data

The notebook and dataset are available on Github.

For a complete course on time series analysis in Python, covering both statistical and deep learning models, check my newly released course!

SARIMA Model

Up until now, we have not considered the effect of seasonality in time series. However, this behaviour is surely present in many cases, such as gift shop sales, or total number of air passengers.

A seasonal ARIMA model or SARIMA is written as follows:

You can see that we add P, D, and Q for the seasonal portion of the time series. They are the same terms as the non-seasonal components, by they involve backshifts of the seasonal period.

In the formula above, m is the number of observations per year or the period. If we are analyzing quarterly data, m would equal 4.

ACF and PACF plots

The seasonal part of an AR and MA model can be inferred from the PACF and ACF plots.

In the case of a SARIMA model with only a seasonal moving average process of order 1 and period of 12, denoted as:

- A spike is observed at lag 12

- Exponential decay in the seasonal lags of the PACF (lag 12, 24, 36, …)

Similarly, for a model with only a seasonal autoregressive process of order 1 and period of 12: